Zambia’s Harshest Mining Conditions Need the Toughest Protection – Call Copper Crest Trading Ltd Today!

Is your mining operation exposed to abrasion, corrosion, or chemical damage? At Copper Crest Trading Ltd, we provide industry-leading protective coatings using Polyurethane, Polyurea, and Hybrid technologies designed to extend the life of your mining equipment—both mobile and fixed.

Our cutting-edge coatings are trusted across the global mining sector and now available right here in Zambia. Built to withstand the toughest environments, our solutions help you reduce downtime, cut maintenance costs, and protect your capital investments.

Call or WhatsApp Copper Crest Trading Ltd today on 📞 +260 771 701655 for a free consultation or quote.

✅ We Protect Equipment That Works As Hard As You Do

Mobile Equipment Protection:

- Battery Trays

- Loading Scoops

- Tipper Bodies

- Cab Floors

- Equipment Beds

- Material Handlers

- Transport Containers

- Service Vehicles

Our coatings create a tough, chemical-resistant, flexible barrier that protects against impact, corrosion, and wear—even in the harshest Zambian mining sites.

Call or WhatsApp Copper Crest Trading Ltd today on 📞 +260 771 701655 for a free consultation or quote.

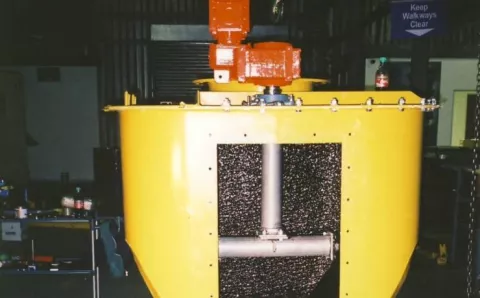

Fixed Plant Equipment Protection:

- Feed Chutes

- Transfer Points

- Storage Bunkers

- Processing Tanks

- Conveyor Systems

- Work Platforms

- Control Rooms

- Loading Zones

Whether it's abrasion from ore, chemical spills, or impact from loading, our coatings protect your fixed installations—boosting operational efficiency and long-term durability.

Call or WhatsApp Copper Crest Trading Ltd today on 📞 +260 771 701655 for a free consultation or quote.

Specialized Protection for:

- Hopper and Chute Linings

- Screen and Pulley Coatings

- Conveyor System Protection

- Vehicle Component Coating

- Chemical Containment (Primary & Secondary)

- Tailings Storage Facilities

Why Choose Copper Crest Trading Ltd?

✅ Zambian-based expert team

✅ Top-grade Rhino Linings protective technologies

✅ Rapid application & minimal downtime

✅ Field-tested results in mining environments

From the Copperbelt to Solwezi, we’re trusted by mining companies that can’t afford failures.

☎️ Protect Your Investment – Act Now!

Call or WhatsApp Copper Crest Trading Ltd today on 📞 +260 771 701655 for a free consultation or quote.

Tough Jobs. Smart Protection. Built for Zambia’s Mines.

Copper Crest Trading Ltd – Your Mining Protection Partner.